Financial Accounting (6th Edition) Edit editionThis problem has been solved:

Looking for the textbook?- CHB

- CHC

- CHD

- CHE

- CH1

- CH2

- CH3

- CH4

- CH5

- CH6

- CH7

- CH8

- CH9

- CH10

- CH11

- CH12

- CH13

- 1E

- 1QS

- 2E

- 2QS

- 3E

- 3QS

- 4E

- 4QS

- 5E

- 5QS

- 6E

- 6QS

- 7E

- 7QS

- 8E

- 9E

- 10E

- 11E

- 12E

- 13E

- 14E

- 15E

- 16E

- 17E

- 18E

- 19E

Capital budgeting: It is a process of selection of project between multiple options available through various techniques. The projects which are available are long-term projects and involve time factor while selecting the optimum project. The project which is most profitable for the company according to the goals set up by the company, will be selected for investment.

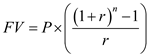

Compute the years of investment made by investor BT through formula of future value of annuity as given below:

Where,

FV is future value of investment

P is the payment made

R is rate of interest

N is number of years

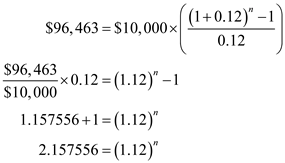

Insert the values given in the problem is formula as shown below:

Now, the equation is in the form of  which is the future value of $1 at 12% rate.

which is the future value of $1 at 12% rate.

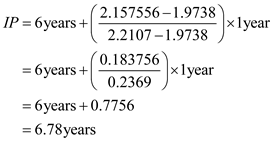

Future value table is given in the problem. Check the future value of 2.157556 at 12% rate to determine the investment period. Exact value is not shown in the table but it falls between 6 years and 7 years.

At 6 years, future value of $1 is 1.9738

At 7 years, future value of $1 is 2.2107.

Interpolate these two years to determine the exact period of investment as given below:

Thus, investment period to invest $10,000 to receive $96,463 at 12% rate should be 6.78 years.

Corresponding textbook

Plus, we regularly update and improve textbook solutions based on student ratings and feedback, so you can be sure you're getting the latest information available.

The best part? As a Chegg Study subscriber, you can view available interactive solutions manuals for each of your classes for one low monthly price. Why buy extra books when you can get all the homework help you need in one place?