Corporate Finance (6th Edition) Edit editionThis problem has been solved:

Looking for the textbook?- CH1

- CH2

- CH3

- CH4

- CH5

- CH6

- CH7

- CH8

- CH9

- CH10

- CH11

- CH12

- CH13

- CH14

- CH15

- CH16

- CH17

- 1MC

- 1Q

- 2Q

- 3Q

- 4Q

- 5Q

- 6Q

- 7Q

- 8Q

- 9Q

- 10Q

Introduction:

The different types of markets are primary market, secondary market, capital market, and money market. The trading procedure in these markets could take place through face to face auction, dealers and on automated trading platforms. All the three are the platform to facilitate trading between the buyer and seller.

Corporate finance is important to the managers because of the following reasons:

• Establishment of corporate strategies.

• Planning for the requirement of fund needed for business operation.

• Comparison analysis of alternatives available to raise funds.

• Selection of most suitable option to raise fund.

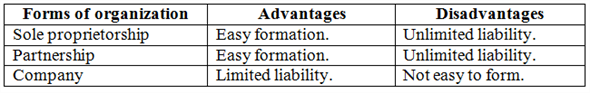

The different organizational forms, their advantages and disadvantages can be summarised as follows:

The corporation can go public by Initial Public Offerings (IPO) and issue of debts. Agency problem arises when the managers working on the behalf of stakeholders work for their own benefit but not in the interest of stakeholders. Corporate governance is the set of rules and regulations established by the government to control the actions of corporations.

The primary objective of the managers should be the maximization of wealth of stakeholders and following the regulations set up by the government.

(1) Yes, the firms have responsibilities to society at large. It is the corporate social responsibility of the company to serve the society and act for the benefit of society.

(2) Yes, stock price maximization is good for society. The maximization of price of stock is the symbolic of good health of the firm. The growth of the firm will be good for the society. It will create more employment.

(3) Yes, the firms should behave ethically. The firm has the responsibility to provide quality product to the society.

The three aspects of cash flows are amount of cash flow, risk involved in cash flow and timing related with the flow of cash.

Free cash flow is the amount of cash available for the distribution to stockholders and creditors after making all the expenses and payments by the organization.

Weighted average cost of capital is the average cost of capital for the company. It is the sum of cost of capital of stocks and debts multiplied by their percentages respectively. Weighted average cost of capital is the average cost of capital of all securities and stocks of the organization.

The intrinsic value of the firm is calculated by dividing free cash flow with weighted average cost of capital. So, the free cash flow and weighted average cost of capital are required while calculating the value of firm.

The net savers of the capital are household and certain foreign governments while the net borrowers of the capital are corporations and Government of the country.

The borrower pays interest for the capital. The two components of cost of equity are referred as dividend and capital gain. The four fundamentals affecting the cost of money and interest rates are risk involved, inflation rate, price of the stock or bond, goodwill of the organization.

The economic conditions affecting the cost of money are fiscal deficit or surplus, Government regulations, international trade policies, and business cycle.

The financial securities are the securities issued in capital and money markets to raise fund. These financial securities are Treasury-bills, Municipal corporations, corporate bonds.

Some of the important financial institutions are banks (commercial and investments), life insurance companies and mutual funds.

The different types of markets are primary market, secondary market, capital market, and money market. The trading procedure in these markets could take place through face to face auction, dealers and on automated trading platforms. All the three are the platform to facilitate trading between the buyer and seller.

The trading procedure is classified on two dimensions of buying and selling of the securities.

p.

Limit order allows the buyer and seller to limit the purchase price and the selling price of the securities but the market order does not allow this. The market order also does not allow accepting orders beyond market hours.

q.

The registered stock exchanges are the place where stocks are listed. These stock exchanges are NYSE, and NASDAQ. The telephone network market is NASDAQ. The alternative trading system can be auction market. In the auction markets the buyers meet the sellers and place their orders. In the dealer market buyers do not meet the sellers directly but indirectly with the help of dealers. But in electronic communication networks the computerised system helps in matching the need of buyer with the offers placed by sellers.

Differences:

• Alternate trading system is not regulated by the stock exchanges. Brokers and dealers are required to get registered at stock exchanges with limitations.

• Initial public offering cannot be done at alternative trading system.

r.

The process of securitisation helps to convert the illiquid assets into securities. The mortgage securitisation is done by creating the illiquid asset into special purpose vehicle. The process of securitisation transforms the illiquid assets and trading and income bearing securities. Hence, it helps in the process of transactions on global platform.

Plus, we regularly update and improve textbook solutions based on student ratings and feedback, so you can be sure you're getting the latest information available.

The best part? As a Chegg Study subscriber, you can view available interactive solutions manuals for each of your classes for one low monthly price. Why buy extra books when you can get all the homework help you need in one place?