2014 FASB Update Intermediate Accounting (15th Edition) Edit editionThis problem has been solved:Solutions for Chapter 4

Looking for the textbook?- CH1

- CH2

- CH3

- CH4

- CH5

- CH6

- CH7

- CH8

- CH9

- CH10

- CH11

- CH12

- CH13

- CH14

- CH15

- CH16

- CH17

- CH18

- CH19

- CH20

- CH21

- CH22

- CH23

- CH24

- 1AAP

- 1BE

- 1C

- 1CA

- 1CAC

- 1E

- 1EB

- 1FRP

- 1ICA

- 1ITQ

- 1P

- 1PB

- 1PR

- 1Q

- 2BE

- 2C

- 2CA

- 2E

- 2EB

- 2ICA

- 2ITQ

- 2P

- 2PB

- 2Q

- 3BE

- 3C

- 3CA

- 3E

- 3EB

- 3ICA

- 3ITQ

- 3P

- 3PB

- 3Q

- 4BE

- 4CA

- 4E

- 4EB

- 4ICA

- 4ITQ

- 4P

- 4PB

- 4Q

- 5BE

- 5CA

- 5E

- 5EB

- 5ICA

- 5ITQ

- 5P

- 5PB

- 5Q

- 6BE

- 6CA

- 6E

- 6EB

- 6ICA

- 6P

- 6PB

- 6Q

- 7BE

- 7CA

- 7E

- 7EB

- 7ICA

- 7P

- 7PB

- 7Q

- 8BE

- 8E

- 8EB

- 8Q

- 9BE

- 9E

- 9EB

- 9Q

- 10BE

- 10E

- 10EB

- 10Q

- 11BE

- 11E

- 11EB

- 11Q

- 12E

- 12EB

- 12Q

- 13E

- 13EB

- 13Q

- 14E

- 14EB

- 14Q

- 15E

- 15EB

- 15Q

- 16E

- 16EB

- 16Q

- 17E

- 17EB

- 17Q

- 18Q

- 19Q

- 20Q

- 21Q

- 22Q

- 23Q

- 24Q

- 25Q

- 26Q

- 27Q

- 28Q

- 29Q

- 30Q

- 31Q

- 32Q

- 33Q

- 34Q

- 35Q

- 36Q

- 37Q

Accounting

The single-step income statement uses a single subtotal for all revenues and a single subtotal for all expenses, with a net income or loss appearing at the end of the report. This statement is most commonly used by the enterprises that have relatively simple operations.

(a)

Single -step income statement of Crows Inc. For the year ended December 31, 2014 is as follows:

| Crows Inc.Income StatementFor the year ended December 31, 2014 | ||

| Particulars | Amount $ | Amount $ |

| Revenues |

|

|

| Sales revenue |

| 1,900,000 |

| Rent revenue |

| 40,000 |

| Total revenues |

| 1,940,000 |

|

|

|

|

| Expenses |

|

|

| Cost of goods sold |

| 850,000 |

| Selling Expenses |

| 300,000 |

| Administrative Expenses |

| 240,000 |

| Income Tax Expense |

| 187,000 |

| Total Expenses |

| 1,577,000 |

|

|

|

|

| Income from continuing operations |

| 363,000 |

| Discontinued operations | (75,000) |

|

| Less: Income tax benefit | 25,500 | (49,500) |

| Income before extraordinary item |

| 313,500 |

| Extraordinary gain | 95,000 |

|

| Less: Applicable Income Tax | (32,300) | 62,700 |

| Net Income |

| 376,200 |

|

|

|

|

| Per share of common stock |

|

|

| Income after tax from continuing operations |

| 3.63 |

| Discontinued operations(net of tax) |

| (0.50) |

| Income before extraordinary items |

| 3.14 |

| Extraordinary item(net of tax) |

| 0.63 |

| Net Income |

| 3.76 |

Therefore, net income is $376,200 .

Notes:

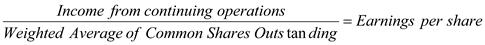

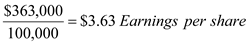

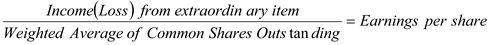

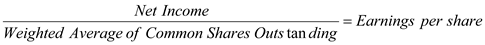

1) For Income from continuing operations after tax, EPS is,

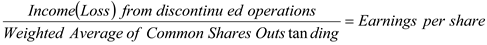

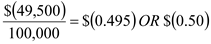

2) For Discontinued operation, EPS is,

Rounded off

3) For Extraordinary item, EPS is,

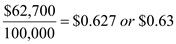

Rounded off

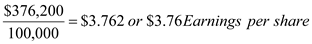

4) For Net Income, EPS is,

Rounded off

(b)

Retained earnings:

Retained earnings are cumulative profits of a company after deducting dividends. Therefore, all year’s profits will add to this fund similarly if the company gets a loss then it will retain from this amount. Retained earnings will report in the stockholders’ equity section of the balance sheet.

Retained Earnings statement of Crows Inc. for the year ended December 31, 2014 is as follows:

| Crows Inc.Retained Earnings StatementFor the year ended December 31, 2014 | |

| Particulars | Amount $ |

|

|

|

| Beginning Balance as on January 1 | 600,000 |

| Add : Net Income during the year | 376,200 |

|

| 976,200 |

| Less: Cash Dividend declared | (80,000) |

| Closing Balance as on December 31 | 896,200 |

(c)

For calculating Comprehensive income statement using two statement formats for the finding of part (a) of the question further to that Comprehensive Income Statement of Crows Inc. for the year ended December 31, 2014 is presented as follows:

| Crows Inc.Comprehensive income statementFor the year ended December 31, 2014 | |

| Particulars | Amount $ |

|

|

|

| Net Income | 376,200 |

| Other comprehensive income |

|

| -Unrealized holding gain on available for sale securities(net of tax) | 15,000 |

| Comprehensive Income | 391,200 |

Analysis

Multiple step Income statement provides data in divisions such as Gross profit related to sales & followed by operational and non-operational profits which is mostly used by big companies & public enterprises, etc. Multiple steps segregate the income statement into categories. From multiple step statement Gross Profit, operational profit etc. is easily available; users of financial statement get the relevancy profits according to sections which help them to make decisions accordingly whereas as in single income statement, it is not possible.

Principles

Such type of reporting is totally inconsistent as per the accounting conceptual framework through various points such as there is always a variance of amounts for extraordinary & inconsistent items that is why these are known as irregular items and it is also inconsistent through the point of comparison. Stakeholders’ will not be able to compare the outcomes and if any company does so they need to furnish the reconciliation statements afterwards for the use of stakeholders.

Corresponding textbook