2014 FASB Update Intermediate Accounting (15th Edition) Edit editionThis problem has been solved:Solutions for Chapter 22

Looking for the textbook?- CH1

- CH2

- CH3

- CH4

- CH5

- CH6

- CH7

- CH8

- CH9

- CH10

- CH11

- CH12

- CH13

- CH14

- CH15

- CH16

- CH17

- CH18

- CH19

- CH20

- CH21

- CH22

- CH23

- CH24

- 1AAP

- 1BE

- 1CA

- 1CAC

- 1E

- 1EB

- 1FRP

- 1ICA

- 1ITQ

- 1P

- 1PB

- 1PR

- 1Q

- 2BE

- 2CA

- 2E

- 2EB

- 2ICA

- 2ITQ

- 2P

- 2PB

- 2Q

- 3BE

- 3CA

- 3E

- 3EB

- 3ICA

- 3ITQ

- 3P

- 3PB

- 3Q

- 4BE

- 4CA

- 4E

- 4EB

- 4ICA

- 4ITQ

- 4P

- 4PB

- 4Q

- 5BE

- 5CA

- 5E

- 5EB

- 5ICA

- 5ITQ

- 5P

- 5PB

- 5Q

- 6BE

- 6CA

- 6E

- 6EB

- 6ICA

- 6P

- 6PB

- 6Q

- 7BE

- 7E

- 7EB

- 7ICA

- 7P

- 7PB

- 7Q

- 8BE

- 8E

- 8EB

- 8ICA

- 8P

- 8PB

- 8Q

- 9BE

- 9E

- 9EB

- 9P

- 9PB

- 9Q

- 10BE

- 10E

- 10EB

- 10P

- 10PB

- 10Q

- 11BE

- 11E

- 11EB

- 11P

- 11PB

- 11Q

- 12BE

- 12E

- 12EB

- 12P

- 12PB

- 12Q

- 13E

- 13EB

- 13Q

- 14E

- 14EB

- 14Q

- 15E

- 15EB

- 15Q

- 16E

- 16EB

- 16Q

- 17E

- 17EB

- 17Q

- 18E

- 18EB

- 18Q

- 19E

- 19EB

- 19Q

- 20E

- 20EB

- 20Q

- 21E

- 21EB

- 21Q

- 22E

- 22EB

- 23E

- 23EB

Change in accounting policy

It is the change in the method of accounting, which affects the financial ratios. Even though the accounting policies are needed to be consistent but there may be some changes for relevance and reliability.

Accounting

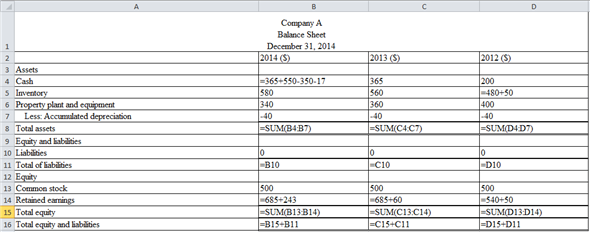

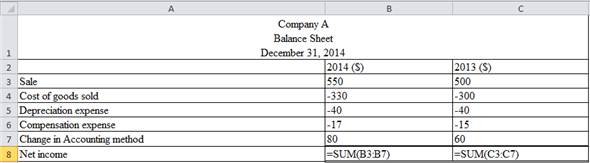

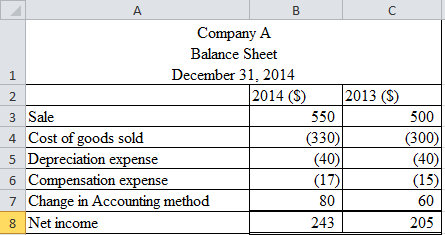

Balance sheet for the year is given below:

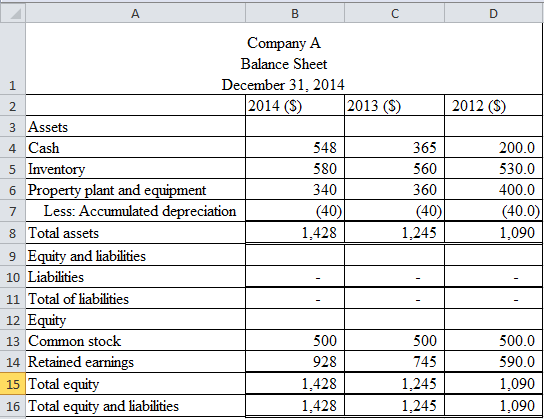

Result of the above table is given below:

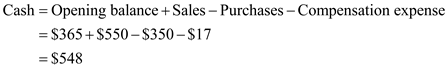

Computation of cash is given below:

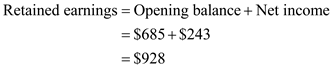

Computation of retained earnings is given below:

Income statement of the year is given below:

Result of the above table is given below:

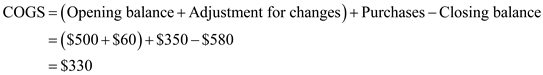

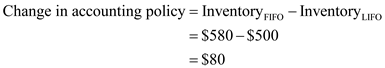

Change in accounting policy is computed below:

Analysis

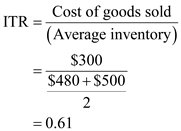

Computation of inventory turnover ratio (ITR) for the year 2013 under LIFO is done as follows:

ITR for 2013 under LIFO method is

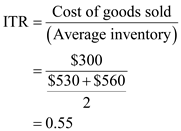

Computation of inventory turnover ratio (ITR) for the year 2013 under FIFO is done as follows:

ITR for 2013 under LIFO method is

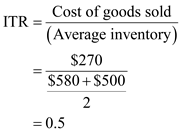

Computation of inventory turnover ratio (ITR) for the year 2014 under LIFO is done as follows:

ITR for 2013 under LIFO method is

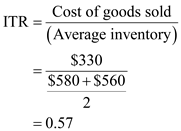

Computation of inventory turnover ratio (ITR) for the year 2014 under FIFO is done as follows:

ITR for 2013 under LIFO method is

The changes in both the methods are due to the difference in the inventories balance in both the methods.

Principles

The changes in accounting policies should be retrospective and the changes should be made to the prior periods too. This is because the change in the current period would be making it difficult to compare the previous year’s data.

So, retrospective effects of changes in the accounting policies should be given.

Corresponding textbook