2014 FASB Update Intermediate Accounting (15th Edition) Edit editionThis problem has been solved:Solutions for Chapter 19

Looking for the textbook?- CH1

- CH2

- CH3

- CH4

- CH5

- CH6

- CH7

- CH8

- CH9

- CH10

- CH11

- CH12

- CH13

- CH14

- CH15

- CH16

- CH17

- CH18

- CH19

- CH20

- CH21

- CH22

- CH23

- CH24

- 1AAP

- 1BE

- 1CA

- 1CAC

- 1E

- 1EB

- 1FRP

- 1FSA

- 1ICA

- 1ITQ

- 1P

- 1PB

- 1PR

- 1Q

- 2BE

- 2CA

- 2E

- 2EB

- 2ICA

- 2ITQ

- 2P

- 2PB

- 2Q

- 3BE

- 3CA

- 3E

- 3EB

- 3ICA

- 3ITQ

- 3P

- 3PB

- 3Q

- 4BE

- 4CA

- 4E

- 4EB

- 4ICA

- 4ITQ

- 4P

- 4PB

- 4Q

- 5BE

- 5CA

- 5E

- 5EB

- 5ICA

- 5ITQ

- 5P

- 5PB

- 5Q

- 6BE

- 6CA

- 6E

- 6EB

- 6ICA

- 6P

- 6PB

- 6Q

- 7BE

- 7CA

- 7E

- 7EB

- 7ICA

- 7P

- 7PB

- 7Q

- 8BE

- 8E

- 8EB

- 8ICA

- 8P

- 8PB

- 8Q

- 9BE

- 9E

- 9EB

- 9ICA

- 9P

- 9PB

- 9Q

- 10BE

- 10E

- 10EB

- 10ICA

- 10Q

- 11BE

- 11E

- 11EB

- 11ICA

- 11Q

- 12BE

- 12E

- 12EB

- 12ICA

- 12Q

- 13BE

- 13E

- 13EB

- 13ICA

- 13Q

- 14BE

- 14E

- 14EB

- 14Q

- 15BE

- 15E

- 15EB

- 15Q

- 16E

- 16EB

- 16Q

- 17E

- 17EB

- 17Q

- 18E

- 18EB

- 18Q

- 19E

- 19EB

- 19Q

- 20E

- 20EB

- 21E

- 21EB

- 22E

- 22EB

- 23E

- 23EB

- 24E

- 24EB

- 25E

- 25EB

Pretax financial income

It is the amount which is reported in the company’s financial statements. The income before deducting income tax and on which the computation of income tax has to be made.

Temporary difference

It indicates the difference between the value of assets or liabilities on tax basis, and the recorded amount in the company’s income statement. These differences consequentially result in deducting the assets or liabilities in the future to report the item in the financial statement.

Accounting

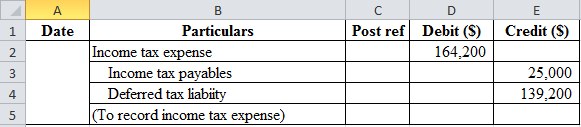

Journal entry for income tax expense is given below:

Income tax expense is an expense and hence, debited. Income tax payables and deferred tax liabilities are liabilities and hence credited.

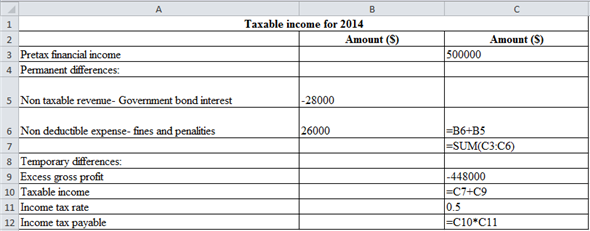

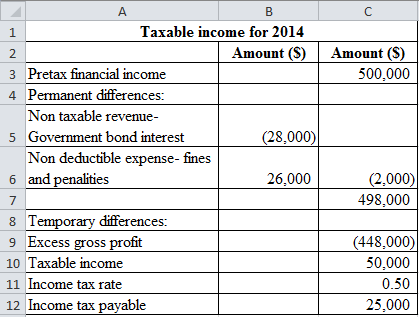

Computation of income tax payables is given below:

Result of the above table is given below:

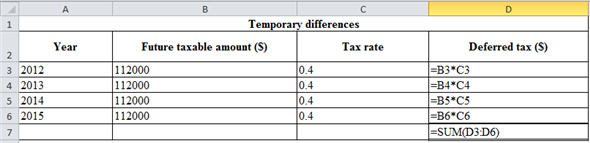

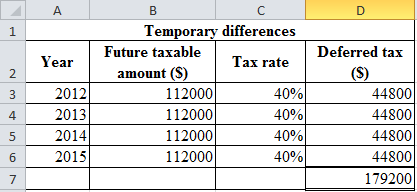

Computation of temporary difference is given below:

Result of the above table is given below:

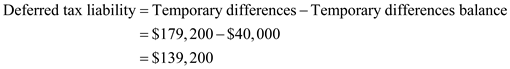

Analysis

The amount of $179,200 of deferred tax liability is the non-current liability and will be shown in the balance sheet in the same manner.

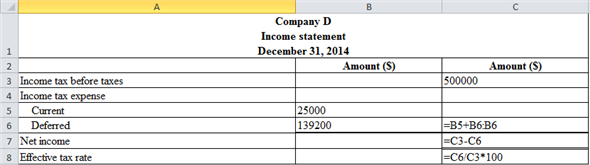

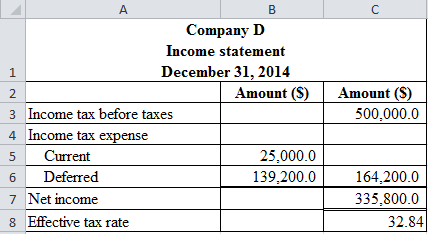

Income statement for the year is given below:

Result of the above table is given below:

Net income for the year is  and effective rate of tax is

and effective rate of tax is

Principles

Framework for the determination of reporting of deferred taxes as assets and liabilities could be used. The framework specifically defines the liabilities and assets.

Corresponding textbook