2014 FASB Update Intermediate Accounting (15th Edition) Edit editionThis problem has been solved:Solutions for Chapter 18

Looking for the textbook?- CH1

- CH2

- CH3

- CH4

- CH5

- CH6

- CH7

- CH8

- CH9

- CH10

- CH11

- CH12

- CH13

- CH14

- CH15

- CH16

- CH17

- CH18

- CH19

- CH20

- CH21

- CH22

- CH23

- CH24

- 1AAP

- 1BE

- 1CA

- 1CAC

- 1E

- 1EB

- 1FRP

- 1FSA

- 1P

- 1PB

- 1PR

- 1Q

- 2BE

- 2CA

- 2E

- 2EB

- 2P

- 2PB

- 2Q

- 3BE

- 3CA

- 3E

- 3EB

- 3P

- 3PB

- 3Q

- 4BE

- 4CA

- 4E

- 4EB

- 4P

- 4PB

- 4Q

- 5BE

- 5CA

- 5E

- 5EB

- 5P

- 5PB

- 5Q

- 6BE

- 6CA

- 6E

- 6EB

- 6P

- 6PB

- 6Q

- 7BE

- 7CA

- 7E

- 7EB

- 7P

- 7PB

- 7Q

- 8BE

- 8CA

- 8E

- 8EB

- 8P

- 8PB

- 8Q

- 9BE

- 9CA

- 9E

- 9EB

- 9P

- 9PB

- 9Q

- 10BE

- 10E

- 10EB

- 10P

- 10PB

- 10Q

- 11BE

- 11E

- 11EB

- 11P

- 11PB

- 11Q

- 12BE

- 12E

- 12EB

- 12P

- 12PB

- 12Q

- 13BE

- 13E

- 13EB

- 13P

- 13PB

- 13Q

- 14BE

- 14E

- 14EB

- 14PB

- 14Q

- 15BE

- 15E

- 15EB

- 15PB

- 15Q

- 16BE

- 16E

- 16EB

- 16PB

- 16Q

- 17BE

- 17E

- 17EB

- 17PB

- 17Q

- 18BE

- 18E

- 18EB

- 18Q

- 19BE

- 19E

- 19EB

- 19Q

- 20BE

- 20E

- 20EB

- 20Q

- 21BE

- 21E

- 21EB

- 21Q

- 22BE

- 22E

- 22EB

- 22Q

- 23BE

- 23E

- 23EB

- 23Q

- 24BE

- 24E

- 24EB

- 24Q

- 25E

- 25EB

- 25Q

- 26E

- 26EB

- 26Q

- 27E

- 27EB

- 27Q

- 28E

- 28EB

- 28Q

- 29E

- 29EB

- 29Q

- 30E

- 30EB

- 30Q

- 31E

- 31EB

- 31Q

- 32E

- 32EB

- 32Q

- 33Q

- 34Q

- 35Q

- 36Q

- 37Q

- 38Q

- 39Q

Revenue Recognition

Revenue Recognition is a principle of accounting which comes under the purview of Generally Accepted Accounting Principles (GAAP) that specifies the conditions according to which revenue is considered or accounted for.

Accounting:

The statement showing the net income for the first quarter is given below:

The net income for the first quarter is.

Working Note 1:

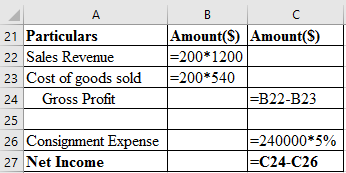

The computation of gross profit from pump bundle is given below:

The above table shows the calculations with the help of formulas.

The resultant table for the above table is given below:

The gross profit from pump bundle is $24,000.

The computation of sales revenue is given below:

The sales revenue amount is $43,800.

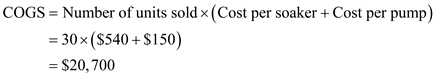

The computation of Cost of Goods Sold (COGS) is given below:

The amount of COGS is $20,700.

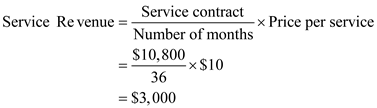

The computation of service revenue is given below:

The amount of service revenue is $3,000.

The computation of expenses is given below:

The amount of expense is $2,100.

Working Note 2:

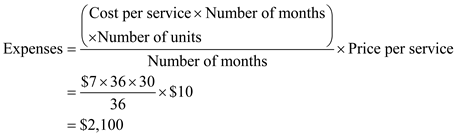

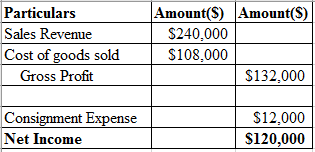

The computation of gross profit from consignment sales is given below:

The above table shows the calculations with the help of formulas.

The resultant table for the above table is given below:

The amount of gross profit is $120,000.

Analysis:

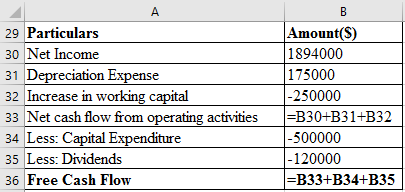

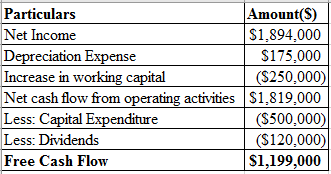

The determination of free cash flow is given below:

The above table shows the calculations with the help of formulas.

The resultant table of the above table is given below:

The amount of free cash flow is .

.

In the process of 5-step model of the revenue recognition, there would be identification of a contract with the customer; then the company identify the obligation of the separate performance. After this, price of the transaction is determined and allocated to the obligations of the performance. And after all this, revenue is recognized when all the obligations are satisfied.

As per the revenue recognition principle, when the customer gets the control over the service or good then the obligation of the performance is satisfied. In the given case of pump sales, when the delivery and installation of the pump is done, then the customer can have control over the asset. When the Company D provides services then the revenue is recognized.

As per the sales in the consignment, M is considered to be an agent and the revenue generated from those sales would be considered when the customer gets control over the service or purchased it.

Corresponding textbook