2014 FASB Update Intermediate Accounting (15th Edition) Edit editionThis problem has been solved:Solutions for Chapter 15

Looking for the textbook?- CH1

- CH2

- CH3

- CH4

- CH5

- CH6

- CH7

- CH8

- CH9

- CH10

- CH11

- CH12

- CH13

- CH14

- CH15

- CH16

- CH17

- CH18

- CH19

- CH20

- CH21

- CH22

- CH23

- CH24

- 1AAP

- 1BE

- 1C

- 1CA

- 1CAC

- 1E

- 1EB

- 1FRP

- 1ICA

- 1ITQ

- 1P

- 1PB

- 1PR

- 1Q

- 2BE

- 2C

- 2CA

- 2E

- 2EB

- 2ICA

- 2ITQ

- 2P

- 2PB

- 2Q

- 3BE

- 3CA

- 3E

- 3EB

- 3ICA

- 3ITQ

- 3P

- 3PB

- 3Q

- 4BE

- 4CA

- 4E

- 4EB

- 4ICA

- 4ITQ

- 4P

- 4PB

- 4Q

- 5BE

- 5CA

- 5E

- 5EB

- 5ICA

- 5ITQ

- 5P

- 5PB

- 5Q

- 6BE

- 6CA

- 6E

- 6EB

- 6ICA

- 6P

- 6PB

- 6Q

- 7BE

- 7CA

- 7E

- 7EB

- 7ICA

- 7P

- 7PB

- 7Q

- 8BE

- 8E

- 8EB

- 8ICA

- 8P

- 8PB

- 8Q

- 9BE

- 9E

- 9EB

- 9ICA

- 9P

- 9PB

- 9Q

- 10BE

- 10E

- 10EB

- 10ICA

- 10P

- 10PB

- 10Q

- 11BE

- 11E

- 11EB

- 11ICA

- 11P

- 11PB

- 11Q

- 12BE

- 12E

- 12EB

- 12ICA

- 12P

- 12PB

- 12Q

- 13BE

- 13E

- 13EB

- 13ICA

- 13Q

- 14BE

- 14E

- 14EB

- 14Q

- 15BE

- 15E

- 15EB

- 15Q

- 16E

- 16EB

- 16Q

- 17E

- 17EB

- 17Q

- 18E

- 18EB

- 18Q

- 19E

- 19EB

- 19Q

- 20E

- 20EB

- 20Q

- 21E

- 21EB

- 21Q

- 22E

- 22EB

- 22Q

- 23E

- 23EB

- 23Q

- 24E

- 24EB

- 24Q

- 25Q

- 26Q

- 27Q

- 28Q

- 29Q

Accounting being the process of preparing financial statements prepares them as per the accounting principles and analyzes the prepared financial statements on the basis of ratios. Accounting principles are the general rule which states the preparation of accounting and financial statements.

Accounting:

The accounting of the organization profit and loss is done through the preparation of journal entries through which income statement can be prepared which denotes the net income of the organization from its operations and also the preparation of balance sheet helps in analyzing the financial performance of the organization on the basis of the ratio analysis tool. The following table shows the Journal entries that which are to be recorded in the books of ‘A’ Corp., for closing Net Income to Retained earnings.

| Date | Particulars | L.F No. | V. No. | Amount | Amount |

| 15/1/2014 | Retained Earnings A/C Dr... To Cash A/C (60,000×$1.05) (Being dividend of $1.05 per share is declared and paid in cash to its share holders) Note : Here we are crediting cash account as the cash has gone out under the principle of debit what comes in and credit what goes out | $63,000 | $63,000 | ||

| 15/4/2014 | Retained Earnings A/C Dr… (60,000×0.1)×$14 To Common Stock A/C To Paid-in Capital in excess of Common Stock A/C (Being 10% of market share price is declared as dividend and paid) Note : Here we are debiting retained earnings account as it is and income and crediting of common stock and paid in excess capital accounts is done as the cash outflow occurred through their dividend payout | $84,000 | $60,000 $24,000 | ||

| 15/5/2014 | Treasury Stock A/C Dr… To Cash A/C(2,000×$15) (Being the 2,000 common stock shares are re-purchased at $15 each) Note: Here we are debiting the treasury stock account as it is acquired and crediting the cash account as the cash outflow happened through purchase. | $30,000 | $30,000 | ||

| 15/11/2014 | Cash A/C Dr…($18×1,000) To Paid-in Capital from Treasury Stock A/C To Treasury Stock A/C (Being the treasury stock of 1,000 from purchased 2,000 is re-issued for $18 each) Note: Here we are debiting the cash account as we acquired the cash and increased the asset value, credited the treasury stock account to show the balance of treasury stock. The difference is the paid-in capital from the treasury stock purchase and issue. | $18,000 | $3,000 $15,000 | ||

| 31/12/2014 | Income Summary A/C Dr… To Retained Earnings A/C (Being the Net Income is reported) Note: Here we have debited Income summary account as the income is reported and credited the retained earnings account as the income is transferred to retained earnings account. | $370,000 | $370,000 |

Now we will be preparing the stock holder equity section of financial statement for ‘A’ Corp., in which the ending balances of the paid-in capital, Retained earnings and stock holders equity can be disclosed and total of stock holders equity can be known. The following table shows the preparation of the financial statement for ‘A’ Corp., in year ending December 31st 2014.

|

|

Statement of Financial Statement ( Equity Section)

December 31st , 2014

Particulars

Amount

Amount

CAPITAL STOCK :

Common Stock (W.N1)

($10 par value per share,66,000 shares issued and outstanding)

66,000×$10

$660,000

ADDITIONAL PAID-IN CAPITAL :

Paid-in Capital in excess of par-common stock (W.N2)

$524,000

Paid-in Capital from treasury stock

$3,000

Total Paid-in Capital

$527,000

Total Capital stock

$1,187,000

Retained Earnings (W.N3)

$843,000

Share Holders Equity before stock issue

$2,030,000

Less : Treasury Stock ( W.N 4)

$15,000

Total Stock Holder Equity

$2,015,000

Working Notes:

1) Common stock is inclusive of stock on hold plus stock outstanding hence the value of common stock would be $60,000+$600,000=$660,000

2) Paid-In Capital is inclusive of paid in capital in excess of par common stock and paid in capital through the dividend pay on basis of market price. Hence the paid-in capital in excess of par common stock would be $500,000+$24,000=$524,000.

3) Retained earnings are inclusive of retained earnings prior to stock and dividend issues that which should be excluded with the dividend payments. Hence the retained earnings at year ending would be $620,000-$63,000-$84,000+$370,000=$843,000.

4) Treasury stock at the end of year would be purchased treasury stock value less the sold treasury stock. Hence the value of treasury stock at the yearend would be $30,000-$15,000=$15,000.

Analysis:

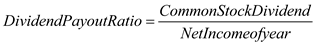

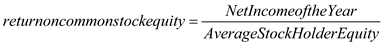

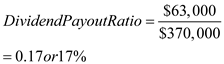

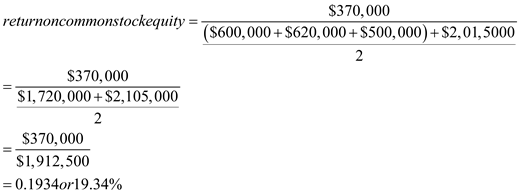

Analysis of ‘A’ Corp., financial performance with usage of ratio analysis tool. The following are the formulas to examine the dividend payout ratio and the return on common stock equity ratio.

Hence with the substitution of given values as per the relevance in the above formula we get the dividend payout ratio and return on common stock equity ratio as,

Principles:

Treasury stock do not result any gain or loss from the sale of stock irrespective of sale above or below cost of stock this is due to the reason that the treasury stock do not come under the asset class . However it is an un-issued equity. More over the gains or losses from the repurchase and reissue of the shares should not be recorded as those transactions are linked with its own share holders; thus the gain or loss from such transactions should not be recorded as income.

Corresponding textbook