2014 FASB Update Intermediate Accounting (15th Edition) Edit editionThis problem has been solved:Solutions for Chapter 13

Looking for the textbook?- CH1

- CH2

- CH3

- CH4

- CH5

- CH6

- CH7

- CH8

- CH9

- CH10

- CH11

- CH12

- CH13

- CH14

- CH15

- CH16

- CH17

- CH18

- CH19

- CH20

- CH21

- CH22

- CH23

- CH24

- 1AAP

- 1BE

- 1C

- 1CA

- 1CAC

- 1E

- 1EB

- 1FRP

- 1ICA

- 1ITQ

- 1P

- 1PB

- 1PR

- 1Q

- 2BE

- 2C

- 2CA

- 2E

- 2EB

- 2ICA

- 2ITQ

- 2P

- 2PB

- 2Q

- 3BE

- 3C

- 3CA

- 3E

- 3EB

- 3ICA

- 3ITQ

- 3P

- 3PB

- 3Q

- 4BE

- 4CA

- 4E

- 4EB

- 4ICA

- 4ITQ

- 4P

- 4PB

- 4Q

- 5BE

- 5CA

- 5E

- 5EB

- 5ICA

- 5ITQ

- 5P

- 5PB

- 5Q

- 6BE

- 6CA

- 6E

- 6EB

- 6ICA

- 6P

- 6PB

- 6Q

- 7BE

- 7CA

- 7E

- 7EB

- 7ICA

- 7P

- 7PB

- 7Q

- 8BE

- 8E

- 8EB

- 8ICA

- 8P

- 8PB

- 8Q

- 9BE

- 9E

- 9EB

- 9ICA

- 9P

- 9PB

- 9Q

- 10BE

- 10E

- 10EB

- 10ICA

- 10P

- 10PB

- 10Q

- 11BE

- 11E

- 11EB

- 11ICA

- 11P

- 11PB

- 11Q

- 12BE

- 12E

- 12EB

- 12ICA

- 12P

- 12PB

- 12Q

- 13BE

- 13E

- 13EB

- 13P

- 13PB

- 13Q

- 14BE

- 14E

- 14EB

- 14P

- 14PB

- 14Q

- 15BE

- 15E

- 15EB

- 15Q

- 16E

- 16EB

- 16Q

- 17E

- 17EB

- 17Q

- 18E

- 18EB

- 18Q

- 19E

- 19EB

- 19Q

- 20Q

- 21Q

- 22Q

- 23Q

- 24Q

- 25Q

- 26Q

- 27Q

- 28Q

- 29Q

- 30Q

- 31Q

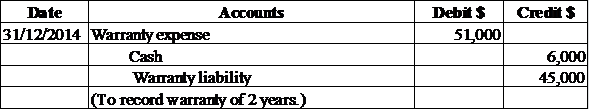

Accounting of warranties:

If there is a promise on behalf of a seller to a buyer in respect of quality, quantity, or performance for a product, then such promise is a warranty. The company provides 2-year warranty.

Journal

The company should debit warranty expense in exchange of cash payment of $6,000 and the liability to pay of $45,000.

Analysis:

• The liquidity of a company depends upon the current ratio. The current ratio is the ratio of current assets to current liabilities. The standard current ratio is 2: 1. It means the current asset is always twice greater than current liability to become a healthy liquidity company.

• The warranty liability is a current liability. Once it is credited it increases the current liabilities and reduces current ratio. The liquidity of the company may be affected due to such increase in warranty liability.

• Cash is a current asset. The company credited cash since the amount is paid. The company reduces the current asset lead to a reduction in current ratio.

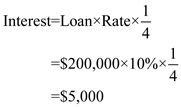

Accounting of loan:

There is an outstanding loan of the company of $200,000. The rate of interest is 10%. See the quarterly interest amount below.

The interest on loan of each quarter is $5,000. One year means 4 quarters. Therefore we should divide the above amount by 4. The due amount of interest is for last quarter, which is December 2014 to February 2015.

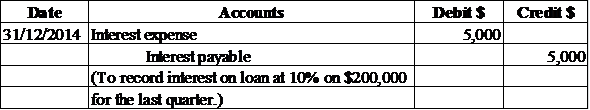

See the interest journal of $5,000 below.

Journal

Any sort of expense is nominal in nature. Therefore we should debit interest expense and credit the liability of interest payable since the amount is not yet paid.

Analysis:

• The liquidity of a company also depends upon the Acid-test ratio. The acid-test ratio is the ratio of current assets less inventories to current liabilities. The standard acid-test ratio is 1: 1. It means each current liability has a back-up of a current asset.

• The interest payable is a current liability. Once it is credited it increases the current liabilities and reduces current ratio. The liquidity of the company may be affected due to such increase in interest payable. Since the company maintains acid-test ratio as 1.25: 1 it is a healthy liquidity situation. It means each current liability has a back-up of 1.25 current assets.

• The importance of the commitment letter: Once the company receives the commitment letter the current portion of long-term debt of $200,000, which was reflected as current liability, will be no longer there and the amount will be included with long-term debt. Since the current liability reduces, the current ratio will be increased, which strengthens the liquidity of the company.

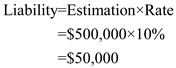

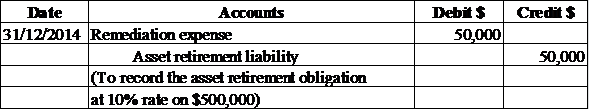

The asset retirement obligation of the company is $500,000. It is under 10% discounting rate. Therefore the liability in each year would be as follows

The asset retirement liability of the company in each year is $50,000. The company should allocate such liability over the life of the facility that is 10 years.

See the journal of $50,000 below.

Journal

Any sort of expense is nominal in nature. Therefore we should debit remediation expense and credit the asset retirement liability for showing obligation.

Analysis:

• The liquidity of a company depends upon the current ratio. The current ratio is the ratio of current assets and current liabilities. The standard current ratio is 2: 1. It means the current asset is always twice greater than current liability to become a healthy liquidity company.

• The asset retirement liability is a current liability. Once it is credited it increases the current liabilities and reduces current ratio. The liquidity of the company may be affected due to such increase in asset retirement liability.

Principles:

• The Company offers 2-year extended warranties to customers for an extra payment of $50 on each purchase. The extended warranty does not meet the definition of a liability under generally accepted accounting principles.

• A company uses to provide extended warranties after receiving money. Therefore the cost of such warranties is covered by the receiving amount. The incident creates no liability of the company.

Corresponding textbook