2014 FASB Update Intermediate Accounting (15th Edition) Edit editionThis problem has been solved:Solutions for Chapter 12

Looking for the textbook?- CH1

- CH2

- CH3

- CH4

- CH5

- CH6

- CH7

- CH8

- CH9

- CH10

- CH11

- CH12

- CH13

- CH14

- CH15

- CH16

- CH17

- CH18

- CH19

- CH20

- CH21

- CH22

- CH23

- CH24

- 1AAP

- 1BE

- 1C

- 1CA

- 1CAC

- 1E

- 1EB

- 1FRP

- 1ICA

- 1ITQ

- 1P

- 1PB

- 1PR

- 1Q

- 2BE

- 2C

- 2CA

- 2E

- 2EB

- 2ICA

- 2ITQ

- 2P

- 2PB

- 2Q

- 3BE

- 3CA

- 3E

- 3EB

- 3ICA

- 3ITQ

- 3P

- 3PB

- 3Q

- 4BE

- 4CA

- 4E

- 4EB

- 4ICA

- 4ITQ

- 4P

- 4PB

- 4Q

- 5BE

- 5E

- 5EB

- 5ICA

- 5ITQ

- 5P

- 5PB

- 5Q

- 6BE

- 6E

- 6EB

- 6ICA

- 6P

- 6PB

- 6Q

- 7BE

- 7E

- 7EB

- 7ICA

- 7Q

- 8BE

- 8E

- 8EB

- 8ICA

- 8Q

- 9BE

- 9E

- 9EB

- 9ICA

- 9Q

- 10BE

- 10E

- 10EB

- 10ICA

- 10Q

- 11BE

- 11E

- 11EB

- 11ICA

- 11Q

- 12BE

- 12E

- 12EB

- 12ICA

- 12Q

- 13BE

- 13E

- 13EB

- 13Q

- 14E

- 14EB

- 14Q

- 15E

- 15EB

- 15Q

- 16E

- 16EB

- 16Q

- 17E

- 17EB

- 17Q

- 18EB

- 18Q

- 19EB

- 19Q

- 20Q

- 21Q

- 22Q

- 23Q

- 24Q

- 25Q

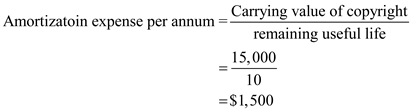

Calculate the amortization expense of copyright.

The following information is given:

Carrying value of copyright = $15,000

Remaining Useful life of copyright = 10 years

As copyright is an intangible asset with definite life, its cost is capitalized and amortized over its useful life.

Prepare the journal entry for the amortization expense of copyright as follows:

| Date | Account titles and explanation | Ref. | Debit $ | Credit $ |

| Dec 31, 14 | Patent amortization expense |

| 1,500 |

|

|

| Patent |

|

| 1,500 |

|

| (To record the amortization expenses) |

|

|

|

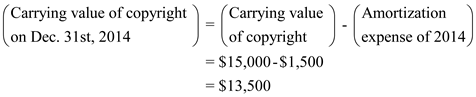

Calculate the carrying value of copyright on 31 st December 2014 as follows:

Note: Trade name has a carrying value of $8,500 and remaining useful life of 5 years which can be renewed at a nominal rate. Therefore, it is considered as an intangible asset with indefinite life. Hence, no amortization is required but test for impairment needs to be performed annually.

Recording Impairment:

Before calculating impairment loss, company performs recoverability test, whereby carrying value of asset is compared with the future cash flow. If carrying value is greater than future cash flow, then the company measures impairment loss using fair value test, whereby difference between the carrying value and fair value is considered as impairment loss.

Impairment test for copyright:

The following information is given:

Carrying value of copyright = 13,500

Expected Future cash flow = 20,000

As carrying value is less than expected future cash flow, copyright should not be impaired.

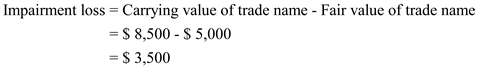

Impairment test for trade name:

Impairment test of assets with indefinite life is a one-step process, whereby company compares carrying value with its fair value. If fair value is less than carrying amount, impairment loss is to be recorded, which is the difference between carrying value and fair value of the intangible asset.

Carrying value of trade name =8,500

Fair value = 5,000

Loss needs to be recorded as carrying value is greater than its fair value impairment.

Prepare a journal entry to record impairment loss on 31 st December 2014 as follows:

| Date | Account titles and explanation | Ref. | Debit $ | Credit $ |

| 31st Dec. | Loss on impairment |

| 3,500 |

|

| 2014 | trademark |

|

| 3,500 |

|

| (To record the loss on impairment recorded ) |

|

|

|

Impairment loss is non-recurring in nature and when charged to operating income, makes operating income more volatile. It worsens in the case of intangible assets with indefinite life as such assets are carried on cost (no amortization). It means that higher carrying value and annual impairment test results in higher impairment loss, which will result in more volatile operating income.

Principle:

Accounting of intangible assets impairment provides relevant information, as it shows that the value of assets declines in a timely manner (asset loses its value with time). However, the reduction in the value of asset in every period depends on the recoverable amount, which in turn, is a result of various estimates. Hence, the reliability of impairment loss amount is affected.

Corresponding textbook