2014 FASB Update Intermediate Accounting (15th Edition) Edit editionThis problem has been solved:Solutions for Chapter 11

Looking for the textbook?- CH1

- CH2

- CH3

- CH4

- CH5

- CH6

- CH7

- CH8

- CH9

- CH10

- CH11

- CH12

- CH13

- CH14

- CH15

- CH16

- CH17

- CH18

- CH19

- CH20

- CH21

- CH22

- CH23

- CH24

- 1AAP

- 1BE

- 1CA

- 1CAC

- 1E

- 1EB

- 1FRP

- 1FSA

- 1ICA

- 1ITQ

- 1P

- 1PB

- 1PR

- 1Q

- 2BE

- 2CA

- 2E

- 2EB

- 2ICA

- 2ITQ

- 2P

- 2PB

- 2Q

- 3BE

- 3CA

- 3E

- 3EB

- 3ICA

- 3ITQ

- 3P

- 3PB

- 3Q

- 4BE

- 4CA

- 4E

- 4EB

- 4ICA

- 4ITQ

- 4P

- 4PB

- 4Q

- 5BE

- 5CA

- 5E

- 5EB

- 5ICA

- 5ITQ

- 5P

- 5PB

- 5Q

- 6BE

- 6E

- 6EB

- 6ICA

- 6P

- 6PB

- 6Q

- 7BE

- 7E

- 7EB

- 7ICA

- 7P

- 7PB

- 7Q

- 8BE

- 8E

- 8EB

- 8ICA

- 8P

- 8PB

- 8Q

- 9BE

- 9E

- 9EB

- 9ICA

- 9P

- 9PB

- 9Q

- 10BE

- 10E

- 10EB

- 10ICA

- 10P

- 10PB

- 10Q

- 11BE

- 11E

- 11EB

- 11ICA

- 11P

- 11PB

- 11Q

- 12E

- 12EB

- 12ICA

- 12P

- 12PB

- 12Q

- 13E

- 13EB

- 13ICA

- 13Q

- 14E

- 14EB

- 14ICA

- 14Q

- 15E

- 15EB

- 15ICA

- 15Q

- 16E

- 16EB

- 16ICA

- 16Q

- 17E

- 17EB

- 17Q

- 18E

- 18EB

- 18Q

- 19E

- 19EB

- 19Q

- 20E

- 20EB

- 20Q

- 21E

- 21EB

- 21Q

- 22E

- 22EB

- 22Q

- 23E

- 23EB

- 23Q

- 24E

- 24EB

- 24Q

- 25E

- 25EB

- 25Q

- 26E

- 26EB

- 26Q

- 27Q

- 28Q

- 29Q

Depreciation:

Depreciation is a measure of the carrying out, consumption of other loss of value of an asset arising from use, expiration of a limited-time of obsolescence through technology and market changes.

Accounting:

a.

Calculation of impairment loss:

Impairment loss = Carrying Amount – Recoverable Value.

Book value of the asset is $36 million - $10 million = $26 million.

Calculation of discounted Cash flows:

Undiscounted cash flows for four years is =

Since the future cash flows is less than the Book value, impairment is applicable.

Now we can calculate the impairment loss as follows.

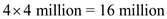

Calculate estimated fair value using cash flows as follows:

Impairment Loss = $16,000,000 - $14,183,800 = $1,816,200.

b.

Calculation of impairment loss:

Impairment loss = Carrying Amount – Recoverable Value.

Book value of the asset is $36 million - $10 million = $26 million.

Calculation of discounted Cash flows:

Undiscounted cash flows for four years =

Since the future cash flows are more than the Book value, impairment charge is not necessary.

Analysis:

If the assets are held for sale, calculate the depreciation. In this case, impairment is to be calculated as follows:

Calculation of discounted cash flows:

Undiscounted cash flows for four years =

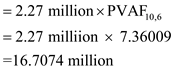

Calculate estimated fair value using cash flows as follows:

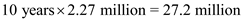

Discounted cash flows

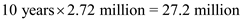

Therefore, the asset is written down to the fair value by reducing the value to = $27.2 million - $16.7074 million = $10.49 million.

Principles:

Under the Generally Accepted Accounting Principles, it is not permitted to restore or write back the impairment value if it is made. But it is permitted in the cash if the asset is held for sale.

In case of IFRS, restoration of impairment loss back is permitted.

Corresponding textbook